FLASH

FLASH

Saturday 13 May 2017

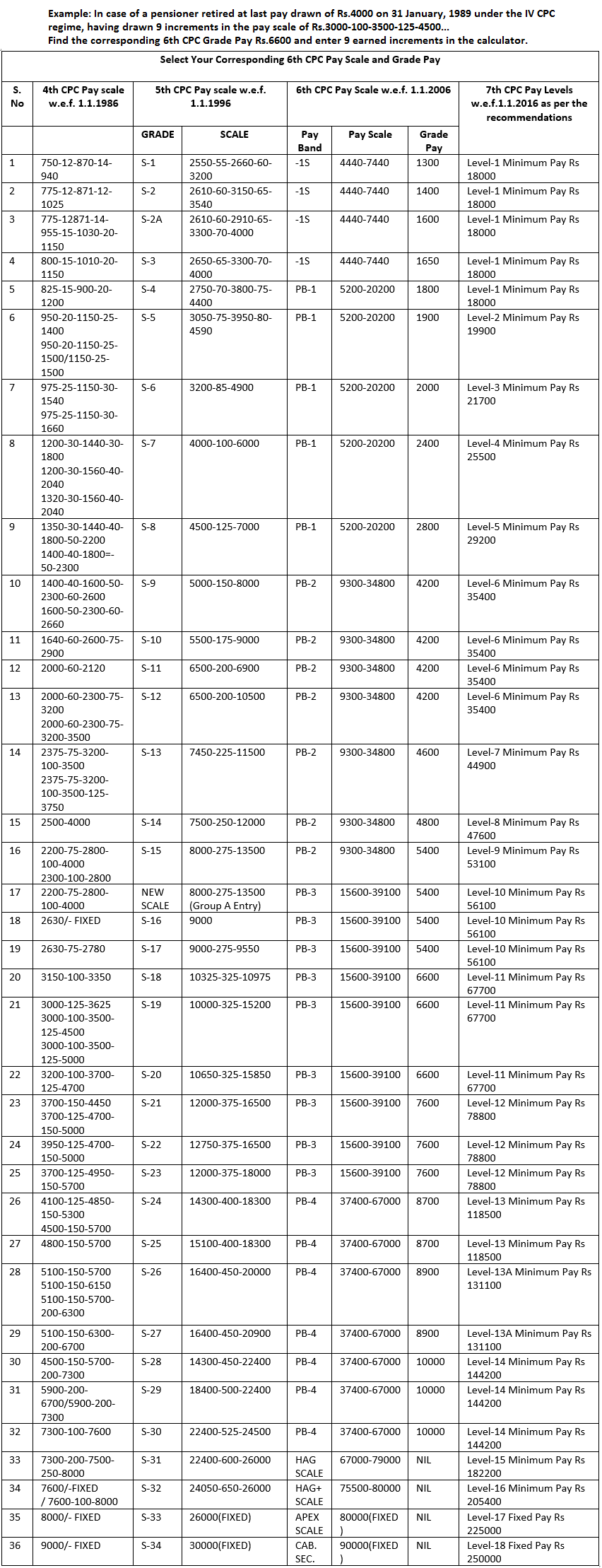

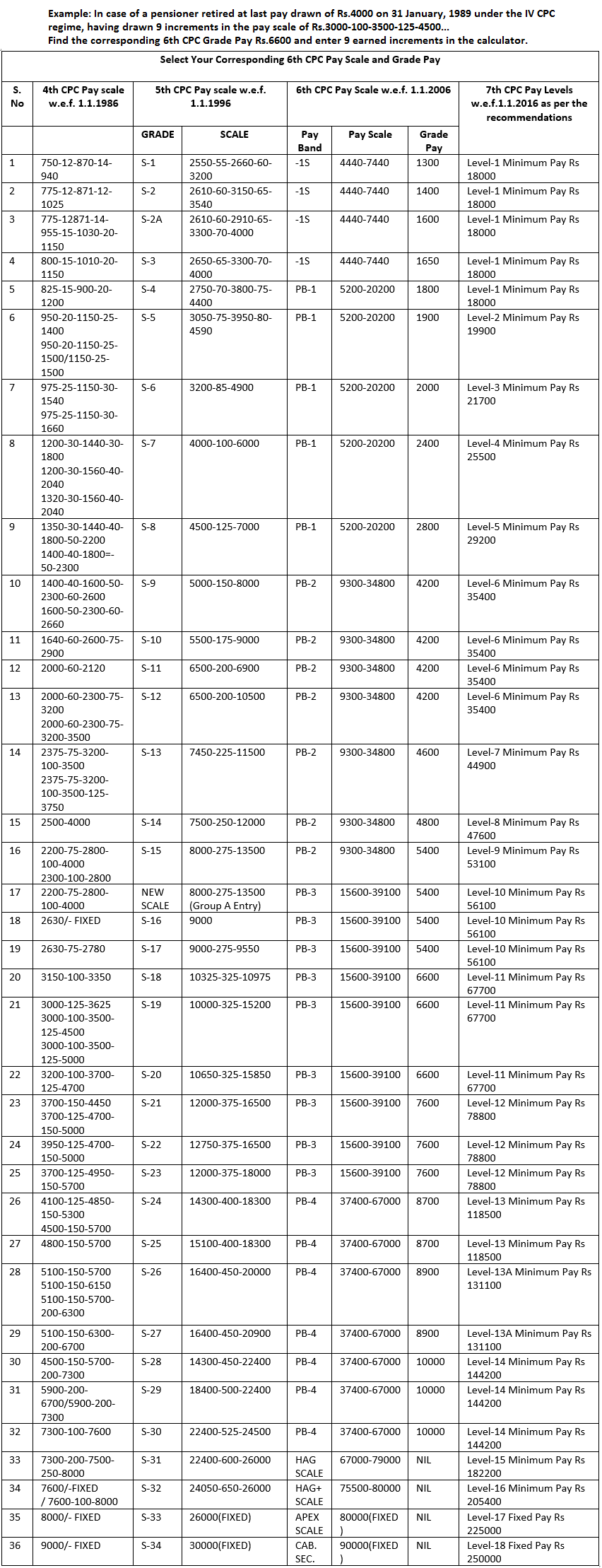

4th, 5th , 6th and 7th Pay Scale Table for 7th CPC Pension Calculator for CGE

7th CPC Revision of Pension of Pre-2016 Pensioners: Order issued

No.38/37/2016-P&PW(A)

Ministry of Personnel, PG & Pensions

Department of Pension & Pensioners’ Welfare

3rd Floor, Lok Nayak Bhawan

Khan Market, New Delhi

Dated, the 12th May, 2017

Office Memorandum

Sub:- Implementation of Government’s decision on the recommendations of the Seventh Central Pay Commission - Revision of pension of pre-2016 pensioners/family pensioners, etc.

The undersigned is directed to say that the 7th Central Pay Commission

(7th CPC). in its Report, recommended two formulations for revision of

pension of pre-2016 pensioners. A Resolution No. 38/37/2016-P&PW (A)

dated 04.08.2016 was issued by this Department indicating the decisions

taken by the Government on the various recommendations of the 7th CPC

on pensionary matters.

2. Based on the decisions taken by the Government on the recommendations

of the 7th CPC, orders for revision of pension of pre-2016

pensioners/family pensioners in accordance with second Formulation were

issued vide this Department’s OM No. 38/37/2016-P&PW (A) (ii) dated 04.08.2016.

It was provided in this OM. that the revised pension/famiiy pension

wet. 112016 of pre-2016 pensioners/family pensioners shall be determined

by multiplying the pension/family pension as had been fixed at the time

of implementation of the recommendations of the 6th CPC, by 2.57.

3. In accordance with the decision mentioned in this Department’s Resolution No. 38/37/2016-P&PW (A) dated 04.08.2016 and OM No. 38/37/2016-P&PW(A) (ii) dated 04.08.2016,

the feasibility of the first option recommended by 7th CPC has been

examined by a Committee headed by Secretary, Department of Pension

Pensioners’ Welfare.

4. The aforesaid Committee has submitted its Report and the

recommendations made by the Committee have been considered by the

Government. Accordingly, it has been decided that the revised

pension/family pension w.e.f 01.01.2016 in respect of all Central civil

pensioners/family pensioners, including CAPF’s, who retired/died

prior to 01.01.2016, may be revised by notionally fixing their pay in

the pay matrix recommended by the 7th CPC in the level corresponding to

the pay in the pay scale/pay band and grade pay at which they

retired/died. This will be done by notional pay fixation under each

intervening Pay Commission based on the Formula for revision of pay.

White fixing pay on notional basis, the pay fixation formulae approved

by the Government and other relevant instructions on the subject in

force at the relevant time shall be strictly followed. 50% of the

notional pay as on 01.01.2016 shall be the revised pension and 30% of

this notional pay shall be the revised family pension wet. 1.1.2016 as

per the first Permutation. In the case of family pensioners who were

entitled to family pension at enhanced rate, the revised family pension

shall be 50% of the notional pay as on 01.01.2016 and shall be payable

till the period up to which family pension at enhanced rate is

admissible as per rules. The amount of revised pension/family pension so

arrived at shall be

rounded off to next higher rupee.

5. It has also been decided that higher of the two Formulations is the

pension/family pension already revised in accordance with this

Department’s OM No. 38/37/2016-P&PW(A) (ii) dated 04.08.2016 or the

revised pension/family pension as worked out in accordance with para 4

above, shall be granted to pre-2016 central

civil pensioners as revised pension/family pension w.e.f. 01.01.2016. In

cases where pension/family pension being paid w.e.f. 1.1.2016 in

accordance with this Department’s OM No. 38/37/2016~P&PW(A) (ii)

dated 04.08.2016 happens to be more than pension/family pension as

worked out in accordance with para 4 above, the pension/family pension

already being paid shall be treated as revised pension/family pension

w.e.f. 1.1.2016.

6. Instructions were issued vide this Department’s OM No.

45/86/97-P&PW(A) (iii) dated 10.02.1998 for revision of pension!

family pension in respect of Government servants who retired or died

before 01.01.1986, by notional fixation of their pay in the scale of pay

introduced with effect from 01.01.1986. The notional pay so worked out

as on 01.01.1986 was treated as average emoluments/last pay for the

purpose of calculation of notional pension/family pension as on

01.01.1986. The notional pension/family pension so arrived at was

further revised with effect from 01.01.1996 and was paid in accordance

with the instructions issued for revision of pension/family pension of

pre-1996 pensioners/family pensioners in implementation of the

recommendations of the 5th Central Pay Commission.

7. Accordingly, for the purpose of calculation of notional pay w.e.f.

1.1.2016 of those Government servants who retired or died before

01.01.1986, the pay scale and the notional pay as on 1.1.1986, as

arrived at in terms of the instructions issued vide this Department’s OM

45/86/97~P&PW(A) dated 10.02.1998, will be treated as the pay scale

and the pay of the concerned Government servant as on 1.1.1986. in the

case of those Government servants who retired or died on or after

01.01.1986 but before 112016 the actual pay and the pay scale from which

they retired or died would be taken into consideration for the purpose

of calculation of the notional pay as on 1.1.2016 in accordance with

para 4 above.

8. The minimum pension with effect from 01.01.2016 will be Rs. 9000/-

per month (excluding the element of additional pension to old

pensioners). The upper ceiling on pension/family pension will be 50% and

30°16 respectively of the highest pay in the Government (The highest

pay in the Government is Rs. 250,000 with

effect from 01.01.2016).

9. The pension/family pension as worked out in accordance with

provisions of Para 4 and 5 above shall be treated as 'Basic Pension'

with effect from 01.01.2016. The revised pension/family pension includes

dearness relief sanctioned from 1.1.2016 and shall qualify for grant of

Dearness Relief sanctioned thereafter.

10. The existing instructions regarding regulation of dearness relief to

employed/re-employed pensioners/family pensioners, as contained in

Department of Pension & Pensioners Welfare OM. No.

45/73/97-P&PW(G) dated 02.07.1999, as amended from time to time,

shall continue to apply.

11. These orders would not be applicable for the purpose of revision of

pension of those pensioners who were drawing compulsory retirement

pension under Rule 40 of the CCS (Pension) Rules or compassionate

allowance under Rule 41 of the CCS (Pension) Rules. The pensioners in

these categories would continue to be entitled to revised pension in

accordance with the instructions contained in this Department’s OM. No.

38/37/2016~P&PW(A)(ii) dated 4.8.2016.

12. The pension of the pensioners who are drawing monthly pension from

the Government on permanent absorption in public sector

undertakings/autonomous bodies will also be revised in accordance with

these orders. However, separate orders will be issued for revision of

pension of those pensioners who had earlier

drawn one time lump sum terminal benefits on absorption in public sector

undertakings, etc. and are drawing one-third restored pension as per

the instructions issued by this Department from time to time.

13. in cases where, on permanent absorption in public sector

undertakings/autonomous bodies, the terms of absorption and/or the rules

permit grant of family pension under the CCS (Pension) Rules, 1972 or

the corresponding rules applicable to Railway employees/members of All

India Services, the family pension being drawn by family pensioners will

be updated in accordance with these orders.

14. Since the consolidated pension will be inclusive of commuted portion

of pension, if any, the commuted portion will be deducted from the said

amount while making monthly disbursements.

15. The quantum of age-related pension/family pension available to the

old pensioners/ family pensioners shall continue to be as follows-

| Age of pensioner/family pensioner | Quantum of pension |

| From 80 years to less than 85 years | 20% of revised basic pension/ family pension |

| From 85 years to less than 90 years | 30% of revised basic pension/ family pension |

| From 90 years to less than 95 years | 40% of revised basic pension/ family pension |

| From 95 years to less than 100 years | 50% of revised basic pension/ family pension |

| 100 years or more | 100% of revised basic pension/ family pension |

The amount of additional pension will be shown distinctly in the pension

payment order. For example, in case where a pensioner is more than 80

years of age and his/her revised pension is Rs.10,000 pm, the pension

will be shown as (i) Basic pension = Rs.10,000 and (ii) Additional

pension = Rs.2,000 pm. The pension on his/her attaining the age of 85

years will be shown as (i).Basic Pension = Rs.10,000 and (ii) additional

pension = Rs.3,000 pm. Dearness relief will be admissible on the

additional pension available to the old pensioners also.

16. A few examples of calculation of pension/family pension in the manner prescribed above are given in Annexure-I to this OM.

17. No arrears on account of revision of Pension/Family pension on

notional fixation of pay will be admissible for the period prior to

1.1.2016. The arrears on account of revision of pension/family pension

in terms of these orders would be admissible with effect from

01.01.2016. For calculation of arrears becoming due on the revision of

pension/ family pension on the basis of this O.M., the arrears of

pension and the revised pension/family pension already paid on revision

of pension/family pension in accordance with the instructions contained

in this Department’s OM No. 38/37/2016-P&PW(A) (ii) dated 04.08.2016

shall be adjusted.

18. it shall be the responsibility of the Head of Department and Pay and

Accounts Office attached to that office from which the Government

servant had retired or was working last before his death to revise the

pension! family pension of Pre-2016 pensioners/family pensioners with

effect from 01.01.2016 in accordance with these orders and to issue a

revised pension payment authority. The Pension Sanctioning Authority

would impress upon the concerned Head of Office for fixation of pay on

notional basis at the earliest and issue revised authority at the

earliest. The revised authority will be issued under the existing PPO

number and would travel to the Pension Disbursing Authority through the

same channel through which the original PPO had travelled.

19. These orders shall apply to all pensioners/family pensioners who

were drawing pension/family pension before 1.1.2016 under the Central

Civil Services (Pension) Rules, 1972, and the corresponding rules

applicable to Railway pensioners and pensioners of All India Services,

including officers of the Indian Civil

Service retired from service on or after 111973. A pensioner/family

pensioner who became entitled to pension/family pension with effect from

01.01.2016 consequent on retirement/death of Government servant on

31.12.2015, would also be covered by these orders. Separate orders will

be issued by the Ministry of Defence in regard to Armed Forces

pensioners/family pensioners.

20 These orders do not apply to retired High Court and Supreme Court

Judges and other Constitutional/Statutory Authorities whose pension etc.

is governed by separate rules/orders.

21 These orders issue with the concurrence of Ministry of Finance

(Department of Expenditure) vide their ID. No. 30~1l33(c)/2016-IC dated

11.05.2017 and ID. No.30-1133(c)/2016-IC dated 12.05.2017.

22. In their application to the persons belonging to the Indian Audit

and Accounts Department, these orders issue in consultation with the

Comptroller and Auditor General of India.

23. Ministry of Agriculture etc. are requested to bring the contents of

these orders to the notice of Heads of Department/Controller of

Accounts. Pay and Accounts Officers, and Attached and Subordinate

Offices under them on top priority basis. All Ministries/Departments are

requested to accord top priority to the work of revision of pension of

ore-2016 pensioners/family pensioners and issue the revised Pension

Payment Authority in respect of all ore-2016 pensioners,

24. Hindi version will follow.

(Harjit Singh)

Director

EXAMPLES

|

| Click for larger image |

Friday 12 May 2017

Reservation for Ex-servicemen in direct recruitment Group ‘C’ posts

No. 11019/20/Misc./2015/MF.CGA(A)/NG/86

Government of India

Controller General of Accounts

Ministry sf Finance

Department of Expenditure

Mahalekha Niyantrak Bhawan

GPO Complex, E-Block, INA

New Delhi – 110023

Controller General of Accounts

Ministry sf Finance

Department of Expenditure

Mahalekha Niyantrak Bhawan

GPO Complex, E-Block, INA

New Delhi – 110023

Dated. the 5th May, 2017

OFFICE MEMORANDUM

Subject: Reservation for Ex-servicemen in direct recruitment Group ‘C’ posts – Regarding

Reference is invited to the reservation,

concessions and relaxations applicable for ex-Servicemen in Central

Government Services (Group ‘C’ posts). The Government of India has been

issuing instructions from time to time for filling up of vacancies under

prescribed quota reserved for ex-servicemen category. In this regard

the DoPT has issued compendium of instruction on reservations for

Ex-servicemen – consolidation of instructions vide OM.

No.3603/4/3/2013-Estt.(Res.) dated 25th February, 2014.

All Pr.CCA.s/CCAs/CAs (with independent

charge) are therefore requested to ensure that the provisions/ rules for

Ex-servicemen notified under Ex-servicemen (Re-employment in Central

Services and Posts) Rules. 1979. as amended from time to time are being

properly followed up/implemented while forwarding of vacancies or direct

recruitment posts to this office for consolidation. The

non-implementation of reservations prescribed for ex-servicemen shall be

treated as violation of Govt. of India’s instructions on the subject.

This. issues with approval of the Jt. Controller General of Accounts (Gr. ‘B’)

(G.Ramesh)

Asstt. Controller General of Accounts (Gr. ‘B’)

Asstt. Controller General of Accounts (Gr. ‘B’)

Source: www.cga.nic.in

Wednesday 10 May 2017

ESM TO GET FACILITIES AT PAR WITH CGHS

Medical facilities available to ESM & their families through

ECHS will be improved. It is planned to bring it at par with CGHS by

extending the facilities of private hospitals available to CGHS

beneficieries to the ECHS beneficieries.

According to the sources in the MOD, principle decision on this

issue has already has been taken. After the implementation of 7 CPC,

decision on the med.facilities too will be taken in the near future.

Even though ECHS beneficieries are entitled for med.facilities at

private hospitals under certain circumstances, yet ESM face difficulties

in getting admission in private hospitals.

Therefore, a CGHS model will be applied in such cases. CGHS

provides admission facilities according to one's designation. Besides,

the grade of payment for ECHS is also very less. According to the

sources in the MOD, CGHS pattern will be applied to ECHS also. The

proposal will be sanctioned very soon.

News item from Hindi Daily 'HINDUSTAN'(Delhi Ed.) Dt 9.5.201

Wednesday 3 May 2017

Seventh Central Pay Commission orders for pay issued by Ministry of Defence

The Ministry of Defence has

issued the orders for the new pay regime on implementation of the recommendations

of the 7th Central Pay Commission for all ranks.

The

orders shall now be

known as Rules rather than Instructions. For example, the modalities for

Ranks other than Commissioned Officers of the Army shall be known as

the “Army Pay Rules” rather than “Special Army Instructions”.

The orders for Commissioned Officers of the Army can be accessed and downloaded by clicking here.

The orders for Commissioned Officers of the Navy can be accessed and downloaded by clicking here.

The orders for Commissioned Officers of the Air Force can be accessed and downloaded by clicking here.

Cabinet approves modifications in the 7th CPC recommendations on pay and pensionary benefits

The Union Cabinet chaired by

the Prime Minister Shri Narendra Modi approved important proposals relating to

modifications in the 7th CPC (Central Pay Commission) recommendations on pay

and pensionary benefits in the course of their implementation. Earlier, in June,

2016, the Cabinet had approved implementation of the recommendations with an

additional financial outgo of Rs 84,933 crore for 2016-17 (including arrears

for 2 months of 2015-16).

The benefit of the proposed

modifications will be available with effect from 1st January, 2016, i.e., the

date of implementation of 7th CPC recommendations. With the increase approved

by the Cabinet, the annual pension bill alone of the Central Government is

likely to be Rs.1,76,071 crore. Some of the important decisions of the Cabinet

are mentioned below:

1.

Revision of pension of pre

– 2016 pensioners and family pensioners

The Cabinet approved

modifications in the recommendations of the 7th CPC relating to the method of

revision of pension of pre-2016 pensioners and family pensioners based on

suggestions made by the Committee chaired by Secretary (Pensions) constituted

with the approval of the Cabinet. The modified formulation of pension revision

approved by the Cabinet will entail an additional benefit to the pensioners and

an additional expenditure of approximately Rs.5031 crore for 2016-17 over and

above the expenditure already incurred in revision of pension as per the second

formulation based on fitment factor. It will benefit over 55 lakh pre-2016

civil and defence pensioners and family pensioners.

While approving the

implementation of the 7th CPC recommendations on 29th June, 2016, the Cabinet

had approved the changed method of pension revision recommended by the 7th CPC

for pre-2016 pensioners, comprising of two alternative formulations, subject to

the feasibility of the first formulation which was to be examined by the

Committee.

In terms of the Cabinet

decision, pensions of pre-2016 pensioners were revised as per the second

formulation multiplying existing pension by a fitment factor of 2.57, though

the pensioners were to be given the option of choosing the more beneficial of

the two formulations as per the 7th CPC recommendations.

In order to provide the more

beneficial option to the pensioners, Cabinet has accepted the recommendations

of the Committee, which has suggested revision of pension based on information

contained in the Pension Payment Order (PPO) issued to every pensioner. The

revised procedure of fixation of notional pay is more scientific, rational and

implementable in all the cases. The Committee reached its findings based on an

analysis of hundreds of live pension cases. The modified formulation will be

beneficial to more pensioners than the first formulation recommended by the 7th

CPC, which was not found to be feasible to implement on account of

non-availability of records in a large number of cases and was also found to be

prone to several anomalies.

2. Disability

Pension for Defence Pensioners

The Cabinet also approved the

retention of percentage-based regime of disability pension implemented post 6th

CPC, which the 7th CPC had recommended to be replaced by a slab-based system.

The issue of disability

pension was referred to the National Anomaly Committee by the Ministry of

Defence on account of the representation received from the Defence Forces to

retain the slab-based system, as it would have resulted in reduction in the

amount of disability pension for existing pensioners and a reduction in the

amount of disability pension for future retirees when compared to

percentage-based disability pension.

The decision which will

benefit existing and future Defence pensioners would entail an additional

expenditure of approximately Rs. 130 crore per annum.

****

Subscribe to:

Posts (Atom)