29 Jan 2018

JANTAR MANTAR PROTEST

MOVEMENT FOR JUSTICE TO JAWAN

Dear Friends,

1.

960

days today since we launched Protest Movement at JM & at other locations

across the country to get Justice to the Soldiers. Actual OROP as our first objective remains far

away. Govt has not fulfilled its

assurance given to the soldiers by PM.

Instead of correcting the OROP Anomalies which have cascading effect on

our Pay, Pensions and Status, Govt has set out to defame, degrade and destroy

our Protest Movement. One Man Judicial

Committee (OMJC) Report on OROP which was submitted to the Govt on 26 Oct 2016

has neither been made public nor implemented.

After making claims for over two years that OROP has been implemented,

Govt has now accepted that full OROP has not yet been given. What the Govt has implemented is one time

increase in pension and not full OROP.

2.

A

Sepoy with 17 years of service and his widow are getting, Rs 4296 and Rs 2548

per month less pension respectively than what should be entitled to them if

full OROP is implemented. These figures

will keep on increasing since the OROP anomalies have cascading effect on our

pensions and status viz other Govt Services.

It is for interest to everyone that other democracies of the world pay

15-20 percent more salary and pension to their soldiers than what India pays to

it soldiers. International Kaleidoscope of

pay and pensions is under:-

Edge in Pay and Pensions of defence

Forces vis-a-vis Civilian Employees

|

Ser No

|

Countries

|

Notional

Edge in salary as service pay or special allowance for military service

|

Pension Scale with notional

edge for military service

|

|

(a)

|

U.S.A

|

Approx 15 to

20%

|

50 to 75% of last pay drawn

fully protected against inflation. For

civil services the scale is 33.75% of pay as pension.

|

|

(b)

|

United Kingdom

|

10%

|

Uniform pension as revised

irrespective of rank and date or retirement.

|

|

(c)

|

Australia

|

#2608 PA

military allowance

|

76.5 percent of day

|

|

(d)

|

Japan

|

12 to 29% on

graded scale

|

70 percent of pay

|

|

(e)

|

West Germany

|

5 to 10%

|

75% of pay

|

|

(f)

|

Yugoslavia

|

15%

|

85 % of pay

|

|

(g)

|

Nigeria

|

5%

|

80% of pay with national edge

of 10% over civil scales.

|

|

(h)

|

France

|

15%

|

75% of pay.

|

|

(j)

|

Iraq

|

10%

|

70-75% of pay.

|

|

(k)

|

Pakistan

|

10-15% with

other allowances

|

50-75% of pay with service

element military pension

|

|

(l)

|

India

|

Nil

|

50% of pay and same is

depressed by 6 to 24% in respect of Lt Col & below ranks constituting 90%

of the manpower strength of the Armed Forces.

|

3.

Not

only

this serious disparity, the Govt has restricted financial assistance for

education including professional education to the Children of Martyrs to Rs

10000/- per month, a schemes which was introduced after the 1971 WAR of full financial assistance for their

education including professional and higher studies. This is retrograde step for the pay and

pensions of soldiers.

4. We

thankfully accept that the present Govt has accepted the Concept of OROP;

however, there are anomalies in its execution which remain to be

corrected. The present Govt would have

got the credit of honouring its assurance to the soldier, had it implemented

full OROP as per the definition given in the Govt Executive orders dated 26 Feb

2014.

5. The approved definition of OROP by two

Governments is given below.

(a) One Rank One Pension (OROP)

implies that uniform pension be paid to the Armed Forces Personnel

retiring in the same rank with the same length of service

irrespective of their date of retirement and any future enhancement

in the rates of pension to be automatically passed on to the past

pensioners. This implies bridging the gap between the rate of pension of the

current pensioners and the past pensioners, and also future enhancements in the

rate of pension to be automatically passed on to the past pensioners”.

(b) Shri

Bhagat Singh Koshyari RAJYASABHA COMMITTEE ON PETITIONS DATED 19 DEC 2011:-

“ One Rank One Pension (OROP) implies that uniform

pension be paid to the Armed Forces Personnel retiring in the same rank with

the same length of service irrespective of their date of retirement and any

future enhancement in the rates of pension to be automatically passed on to the

past pensioners. This implies bridging the gap between the rate of

pension of the current pensioners and the past pensioners, and also future

enhancements in the rate of pension to be automatically passed on to the past

pensioners”

(c)

Report

of Committee of Secretaries on OROP 30 June 2009. Relevant

Extract is as under :-

“One Rank

One Pension (OROP) implies that uniform pension be paid to the Armed

Forces Personnel retiring in the same rank with the same length of

service irrespective of their date of retirement and any future

enhancement in the rates of pension to be automatically passed on to the

past pensioners”

(d)

Minister of State for Defence Rao Inderjit Singh in

a written reply to Shri Rajeev Chandrasekhar in Rajya Sabha dated 02 Dec 2014

(Release ID :112372)

“The principle of One

Rank One Pension for the Armed Forces has been accepted by the Government.

One Rank One Pension (OROP) implies that uniform pension be paid to the Armed

Forces personnel retiring in the same rank with the same length of service

irrespective of their date of retirement and any future enhancement in the

rates of pension to be automatically passed on to the past pensioners. This

implies bridging the gap between the rate of pension of the current pensioners

and the past pensioners, and also future enhancement in the rate of pension to

be automatically passed on to the past pensioners.”

5. I had the opportunity to meet the

present RM on 15 Nov 2017 in her office in a very cordial environment and

briefed her in detail about the anomalies in the implementation of OROP and other

important Issues of Welfare of Defence Personnel are as under.

(a) Implementation of Actual One Rank One

Pension (OROP).

(b) Pensions of Defence Widows.

(c) Pensions of Defence Reservists.

(d) Ensuring Second Career for the early Defence

Retirees till the age of 60 years through the Act of Parliament.

(e) Improvements in Medical care Scheme

ECHS. The medical procedures which have

been introduced in the Country be on ECHS Procedure list within, six months of

their being operational in India.

(f) Dire need to have Veterans Hospitals on the

line of other Democracies.

(g) Need to enhance ECHS Budget to efficiently

manage Super Specialty Care for the Defence Personnel and their dependents.

(h) Need to have Covenant Act of Defence Forces

on the lines of UK & other countries.

(j) Need to expedite construction of Martyrs

Memorial at India Gate. Long delays have

already been caused.

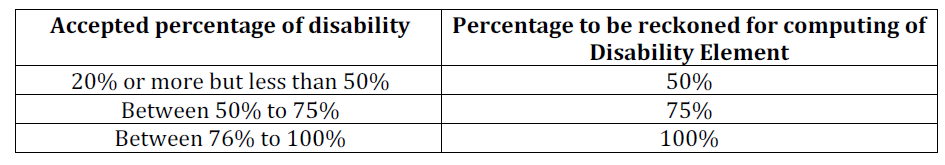

(k) Need to enhance rates of Disability Pension

for Defence Personnel.

6. Having given the details, I would

request all members of the defence Family to “Join in” to continue our struggle

to get “Respect and Justice” to the soldiers and for restoration of status in

all respects as existed on 26 Jan 1950.

7. You are aware that the Govt has to

implement Actual OROP and the opposition has to raise the issues of disparities

and shortcomings that exist. We had

supported BJP in 2014 when the party had assured us of implementation of full

OROP if it came to Power. Now, since BJP has not implemented full OROP, we have

requested opposition ie (Cong and other Parties) to assist in getting actual OROP

for the Welfare of Soldiers. We neither

joined BJP in 2014 nor we have joined cong now.

Some ex- servicemen for the reasons best known to them are making

subjective comments that the IESM Leadership has joined Congress. It is for from truth. IESM and Jantar Mantar Protest Movement is

for the Welfare of Defence Family and not for joining any Political Party.

8. We appeal to all Ex-Servicemen to

strengthen the Protest Movement at Jantar Mantar and other locations in the

Country by Continuing to be part of it.

Every Ex-serviceman in and

around NCR is requested to visit Jantar Mantar atleast once a week to Showcase

Solidarity to the Cause of Soldiers. Likewise,

ESM at other locations are requested to conduct meetings at their respective

places in support of Respect, Justice, Status, Actual OROP and Removal of

Anomalies of 6th & 7th CPCs.

With

regards,

Yours Sincerely,

Maj

Gen Satbir Singh, SM (Retd)

Advisor

United Front of Ex Servicemen and Chairman IESM

Mobile:

09312404269, 0124-4110570