PCDA Circular No.596 – 7th Central Pay Commission – Revision of Disability/ War Injury pension for Pre-01.01.2016 Defence Forces pensioners

Dated: 09th February, 2018

To,

1. The Chief Accountant, RBI, Deptt. Of Govt. Bank Accounts, Central

office C-7, Second Floor, Bandre- Kurla Complex, P B No. 8143, Bandre

East Mumbai- 400051

2. All CMDs, Public Sector Banks including IDBI Bank

3. Nodal Officers, ICICl/ HDFC/ AXIS/ IDBI Banks

4. Managers, All CPPCs

5. Military and Air Attache, Indian Embassy, Kathmandu, Nepal

6. The PCDA (WC), Chandigarh

7. The CDA (PD), Meerut

8. The CDA, Chennai

9. The Director of Treasuries, All States

10. The Pay and Accounts Officer, Delhi Administration, RK Puram and Tis Hazari, New Delhi

11. The Pay and Accounts Office, Govt of Maharashtra, Mumbai

12. The Post Master Kathua (J&K)

13. The Post Master Camp Bell Bay

14. The Pr. Pay and Accounts Officer, Andaman and Nicobar Administration, Port Blair

2. All CMDs, Public Sector Banks including IDBI Bank

3. Nodal Officers, ICICl/ HDFC/ AXIS/ IDBI Banks

4. Managers, All CPPCs

5. Military and Air Attache, Indian Embassy, Kathmandu, Nepal

6. The PCDA (WC), Chandigarh

7. The CDA (PD), Meerut

8. The CDA, Chennai

9. The Director of Treasuries, All States

10. The Pay and Accounts Officer, Delhi Administration, RK Puram and Tis Hazari, New Delhi

11. The Pay and Accounts Office, Govt of Maharashtra, Mumbai

12. The Post Master Kathua (J&K)

13. The Post Master Camp Bell Bay

14. The Pr. Pay and Accounts Officer, Andaman and Nicobar Administration, Port Blair

Subject:

Implementation of Government decision on the recommendations of the 7th

Central Pay Commission (CPC)- Revision of Disability/ War Injury pension

for Pre-01.01.2016 Defence Forces pensioners reg.

Reference: This office Circular No. 570 dated 31.10.2016, Circular No.

582 dated 05.09.2017 and Circular No. 585 dated 21.09.2017.

(Available on this office website www.pcdapension.nic.in)

Copy of GOI, MOD letter No. 17(01)/2017(01)/D(Pen/Policy) dated 23rd

January, 2018 on the above subject, which is self-explanatory, is

forwarded herewith for further necessary action at your end.

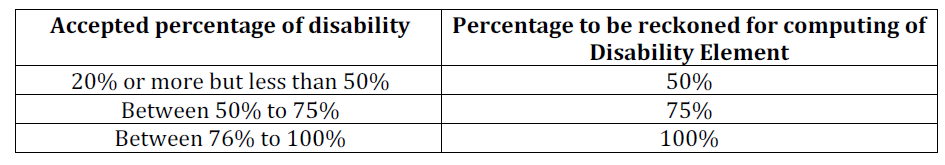

2. In terms of Para-2 of GOI, MOD letter No. 17(01)/2017(01)/D(Pension/

Policy) dated 04th September,2017, Disability Element of Disability

Pension to Armed Forces Pensioners has to be revised by multiplying the

existing rate of Disability Element as had been drawn on 31.12.2015 by

factor of 2.57 to arrive at revised rate of Disability Element as on

01.01.2016. Further, in terms of Para-5.2 & 5.3 of GOI, MOD letter

No. 17(01)/2017(02)/D(Pension/Policy) dated 05th September’ 2017,

Disability Pensionary awards has to be revised on notional pay fixation

method and benefits of broad banding will be given to discharge cases

also as in invalided out cases and these will be done by issuing

Corrigendum Pension Payment Order (PPO).

3. Now, consequent upon the issue of GOI, MOD letter dated 23rd January,

2018, the cases where Armed Forces Pensioners who were retired/

discharged voluntary or otherwise with disability and they were in

receipt of Disability/ War Injury Element as on 31.12.2015, their extent

of disability/ War Injury Element shall be re-computed in the following

manner given below, before applying the multiplication factor of 2.57

on existing disability/ war injury element as on 31.12.2015 for getting

the revised disability/ war injury element as on 01.01.2016 in

accordance to Para-2 of GOI, MOD letter No. 17(01)/2017(01)/D(Pension/

Policy) dated 04th September’ 2017.

4. The Note below Para-12 of GOI, MOD letter No. 17(01)/2016-D(Pen/Pol)

dated 29th October, 2016 (circulated vide Circular No. 570 dated

31.10.2016) stands deleted. In other words, quantum of additional

pension available to old age pensioners after attaining the age of 80

years and above shall also be admissible on revised disability/ war

injury element.

5. It is also stated that PDAs

may take utmost care during revision of Disability/War Injury Element

as per this order in those cases where the pensioners who are in receipt

of 50% of Disability/ War Injury Element of Disability/ War Injury

Pension. If the individual has already been given rounding of benefit

through PPO (in invalided out cases) then rounding of benefit in such

cases should not be given. However, where his disability was

assessed as 50% in discharge cases then it will be rounded to 75% as

mentioned in Para-3 above. If the PDAs found any problem regarding

identification of such cases the same may please be forwarded to Audit

Section of this office.

6. All Pension Disbursing Agencies handling disbursement of pension to

the Defence Pensioner are hereby authorized to pay benefit of rounding

off disability/ war injury and additional pension as per Para 3 & 5

above without any further authorization from the concerned Pension

Sanctioning Authorities.

7. Provisions of GOI, MOD letter No. 17(01)/2017(01)/D(Pen/Policy) dated 23rd January, 2018 shall take effect from 01.01.2016.

8. This circular has been uploaded on this office website

www.pcdapension.nic.in for dissemination to all alongwith Defence

pensioners and Pension Disbursing Agencies.

S/d,

Dy. Controller(P)

Dy. Controller(P)

No comments:

Post a Comment